From Zero to IPO in Just 4 Years

Lemonade Insurance Nailed it!

Not just that,

Its shares doubled on the first morning of trading.

The Secret to Success

Lemonade’s success comes from understanding the buyer’s journey and aligning their sales process to it.

Here’s a quote from CEO and co-founder Daniel Schreiber that sums up their ethos:

“One of the factors that stood out most to us when building a new kind of insurance company was the conflicted interests and lack of transparency. It was mind-boggling that an industry that is performing such an important societal role is perceived so negatively. Insurance fraud is a serious symptom of this. That’s why we made transparency and overcoming conflicts of interest a significant pillar of Lemonade.”

Creating Love in a Deeply Hated Industry

Lemonade Inc. is reshaping the insurance industry. Their formula for success is simple but powerful:

Step 1: Thoroughly understanding the Buyer’s Journey.

Step 2: Removing pain through innovative solutions.

By keeping the Millennial buyer persona in mind, they’ve created seamless experiences for users.

The Buyer’s Journey for Insurance

Insurance buyers go through two painful stages:

- Comparing and choosing the right policy.

- Claiming insurance money (if needed).

Let’s dive deeper into these stages.

Stage 1: Comparing and Choosing the Right Insurance Policy

Emotional State: Curious, gathering information about insurance.

Pain-Points:

- Policies are often full of jargon, hard to understand.

- The “Conditions Applied” section is confusing and deceptive.

What Buyers Look For:

- What’s covered?

- Is the monthly premium affordable?

- Are the terms clear?

How Lemonade Solves This:

- Content Strategy: Educational blog posts that guide the buyer through the process.

- Impressive User Experience: Mobile-friendly, easy-to-understand content with clear FAQs.

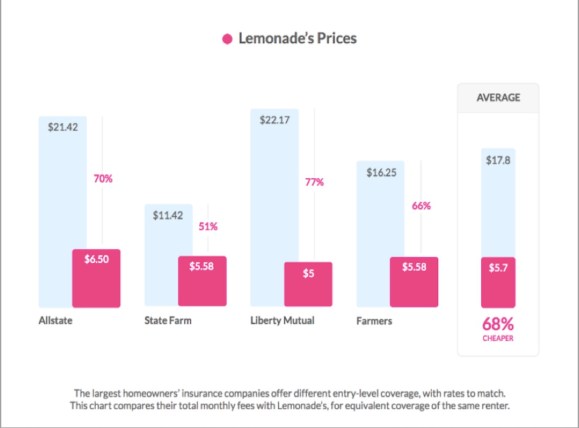

- Comparison Tables: They lay out comparisons with major players, making it easier to choose.

Businesses can simplify decision-making and reduce confusion for potential customers by aligning the sales process with the buyer’s journey.

Example:

A blog post titled “How to Buy Affordable Home Insurance Online?” answers all key buyer questions:

- Is a cheaper home insurance policy actually better?

- What makes a homeowner’s policy unique to you?

- Does coverage affect the price?

- Can I get a discount on my policy?

- How do claims work?

Lemonade addresses each question in plain, simple English, which alleviates buyer concerns.

Often buyers find it difficult to make the right choice for the policy.

Lemonade insurance has made that also super easy.

Take a look at this.

Stage 2: Claiming Insurance Money (If Needed)

Emotional State: Scared, frustrated.

Pain-Points:

- The slow, bureaucratic process of negotiating with insurance agents.

- The long wait to get paid.

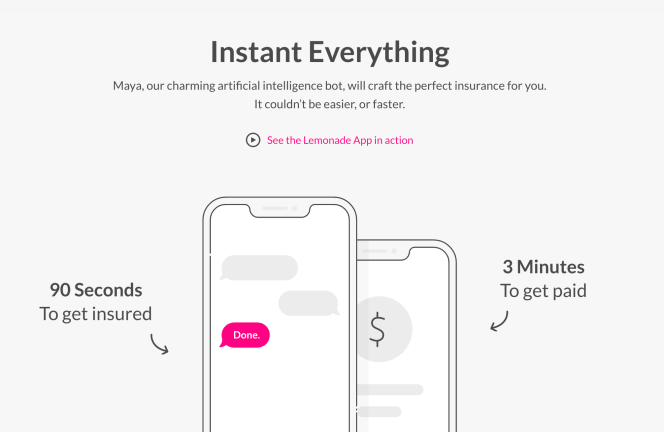

How Lemonade Solves This:

- Fast, hassle-free claims: In just 90 seconds, Jim reported his stolen laptop, and in minutes, $2000 was debited into his account. No negotiation, no paperwork!

Lemonade makes the process incredibly fast and user-friendly.

For companies looking to increase sales by focusing on the buyer’s journey, great insights are shared in this teardown of how businesses can delight customers by removing friction.

Pro tip: If you need 30 standout SaaS growth hacks to attain double the growth for your SaaS business, fill out the form below!

Lemonade vs. Traditional Insurance Companies

Here’s a quick comparison between Lemonade and traditional insurance companies:

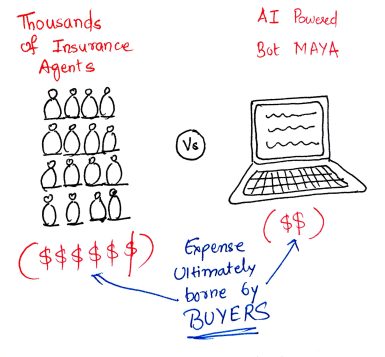

#1 AI-Powered Bot (MAYA) vs. 1000s of Insurance Agents:

Lemonade uses a bot, which reduces overhead and passes the savings onto the buyer.

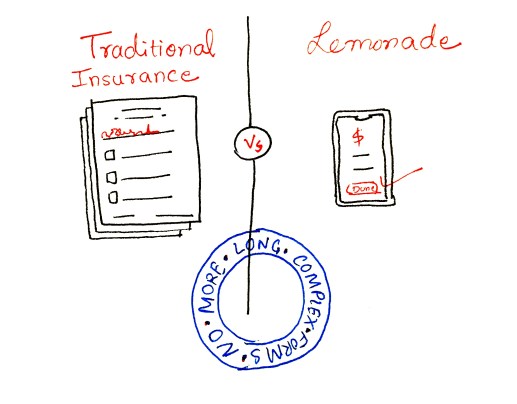

#2 Long Forms vs. Few Clicks on the Phone:

Instead of long forms, Lemonade lets buyers speak into their phones to get covered.

#3 Profit-Driven vs. Giving Back to Society:

Lemonade operates on a flat-fee model, with any leftover funds after claims going to charity.

This business model benefits the buyer in two ways:

- The company doesn’t have an incentive to settle claims for less.

- It encourages honesty from buyers since making a false claim hurts the community.

Lemonade’s ability to remove buyer pain stems from its deep understanding of customer needs.

This same principle applies across industries, successful SaaS companies are also using a similar buyer-centric approach to scale their businesses.

How Are You Taking Away the Pain That Buyers Have?

Lemonade has addressed common buyer pain-points in unique ways. How is your business addressing your customers’ pain?

If you’re unsure how to do it, we’re here to help. Feel free to share your thoughts in the comments below.

Final Thoughts:

Lemonade’s success lies in its ability to understand and address buyer pain-points in a fresh, innovative way. How is your business handling the buyer’s journey? Are you removing friction and delivering an outstanding experience?

At Concurate, we help businesses like yours create high-impact content strategies that not only educate but engage your audience at every stage of their journey.

If you want to enhance your approach, drive more conversions, and grow your business, let’s connect over a short call.

Block our calendar today and take the first step towards transforming your content marketing strategy.