| TL;DR: LexisNexis is proof that when expertise meets execution, visibility compounds. This SEO analysis reveals how their content quietly drives dominance. |

Every Friday at Concurate, we take on something new. A company teardown, a marketing report, or an SEO deep dive that makes everyone think differently. The idea is simple. One learns, everyone learns.

This week, our focus turned to legal tech companies, and few names carry more weight than LexisNexis. Ideally, it became the subject of this teardown.

Founded in the early 1970s as one of the first online legal research systems, it has grown into a global data and analytics powerhouse. Today, it powers decisions across law, risk, and compliance – from AI-driven legal drafting to fraud detection and healthcare analytics.

Our question was simple: what drives its dominance? Which keyword clusters help it capture buyers in the commercial and transactional stages of search? What kind of content converts attention into trust?

This LexisNexis SEO analysis uncovers the answers.

Mapping The Search Territory Of LexisNexis

The fifty-year-old innovator isn’t just a strong player in the information systems space. It has built a powerful content strategy that strengthens visibility across industries.

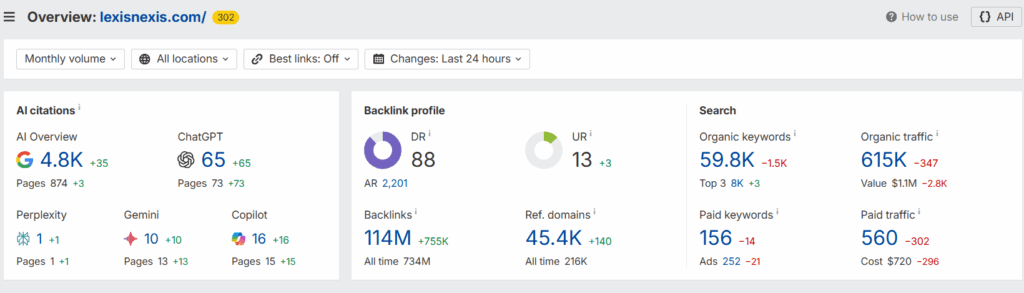

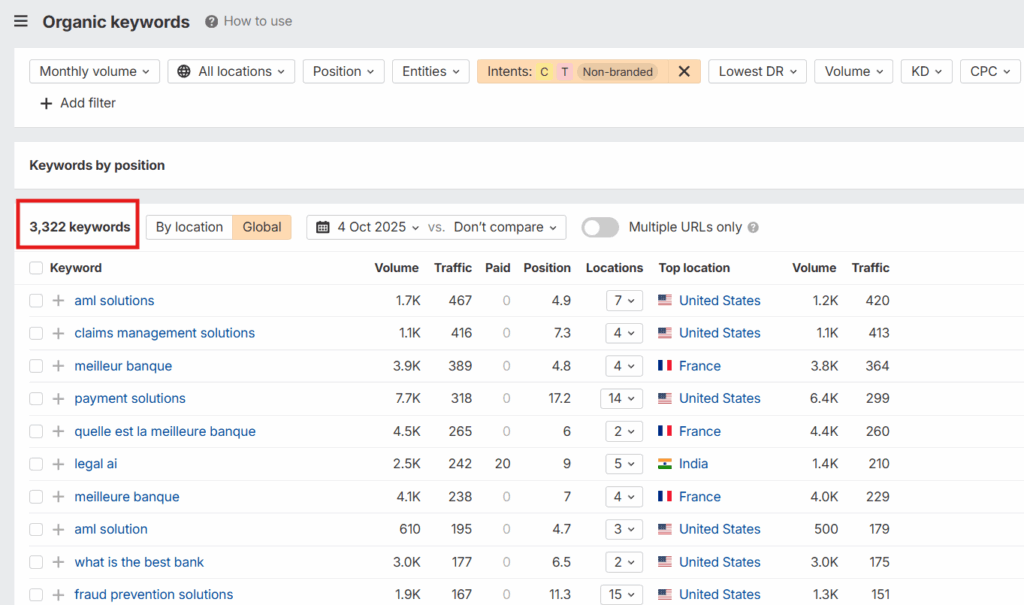

When we looked it up on Ahrefs, the numbers spoke for themselves. It ranks for over 59,000 keywords. That is a staggering footprint for any legal tech brand.

Source – ahrefs

But we wanted to know more. Which keywords actually capture buyers in motion? The ones researching options, comparing tools, booking demos, and evaluating platforms. In other words, the buyers that are in the consideration and decision stages of the marketing funnel.

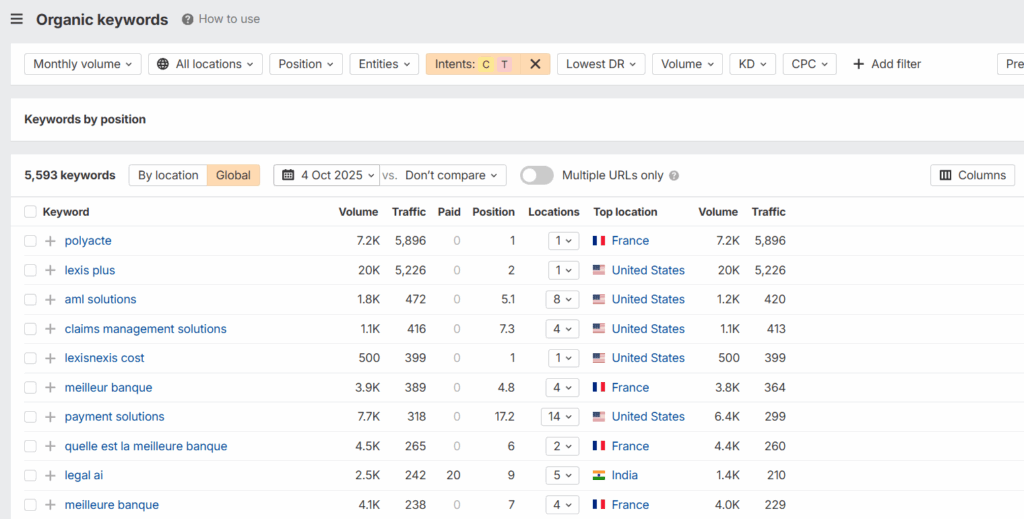

So, we filtered the data for commercial and transactional intent keywords. Here’s what surfaced.

Zeroing In On Non-Branded, Bottom-Funnel Keywords

We started with 5,593 commercial and transactional keywords, but a big share of them were branded.

To really see how LexisNexis drives conversions, we narrowed the scope to non-branded terms. That brought the list down to around 3,200 keywords.

Once we started analyzing these keywords, clear patterns began to emerge. LexisNexis had gained strong coverage around its flagship solutions, especially in compliance and risk.

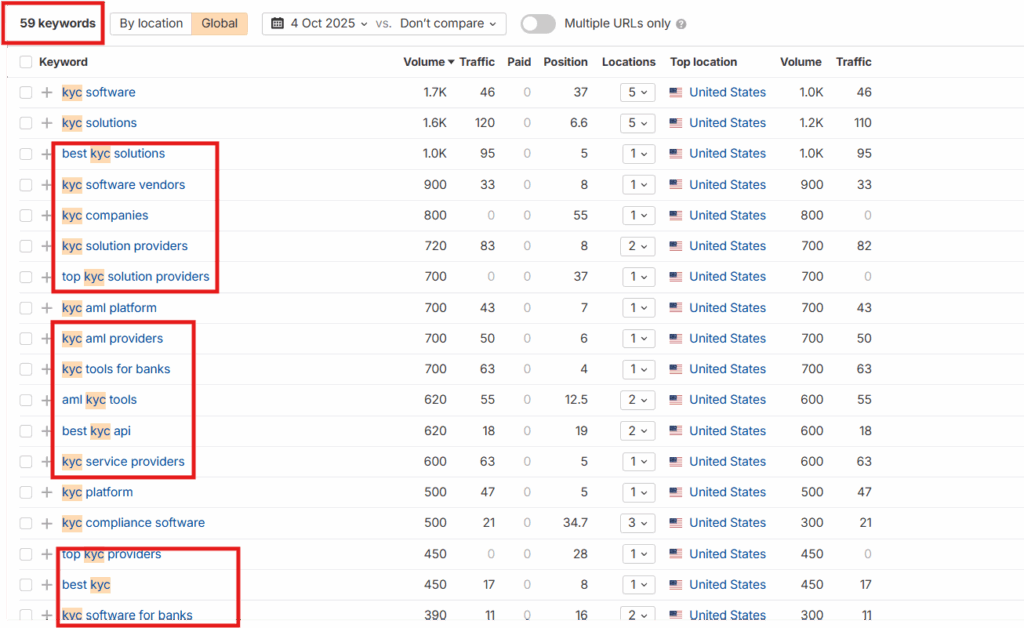

The KYC Cluster

One standout cluster is KYC, where they rank across a wide spread of terms like KYC software, KYC solutions, best KYC API, and KYC software for banks.

What’s striking is how they approach this coverage. Instead of relying on blog posts, LexisNexis dominates these searches with glossary entries, product landing pages, and even press releases.

Even for high-intent queries like top KYC solutions or KYC solution providers, where one might think they would have some kind of blog around the topic, they lead with this glossary pages, making conversion smooth by moving prospects directly from search to solution with well-designed pages.

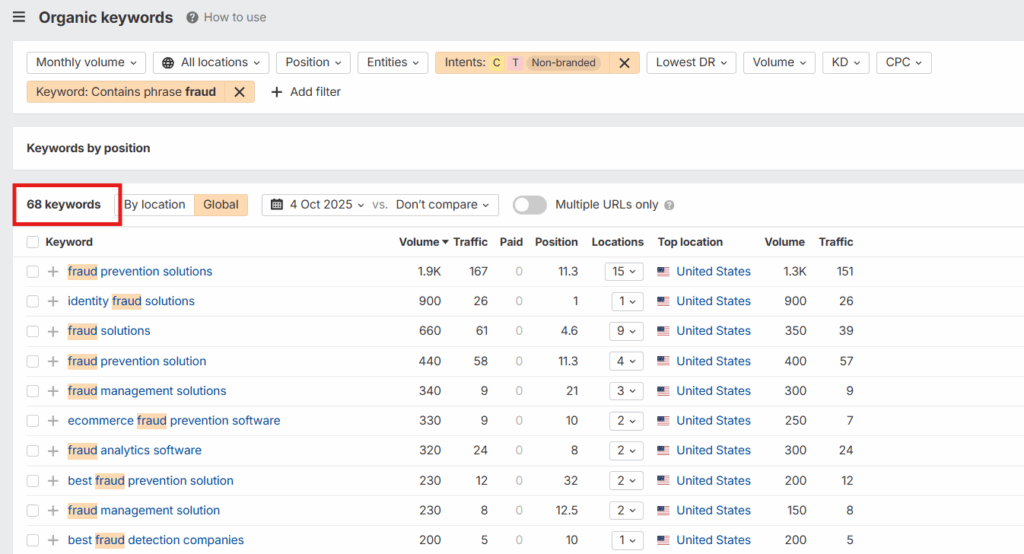

Focusing On Fraud Prevention

We also found a strong cluster around fraud prevention. In total, there were 68 keywords tied to this theme, covering searches like fraud prevention solutions, identity fraud solutions, and fraud analytics software.

Here too, LexisNexis relies on dedicated solution pages, report posts, and even informational articles.

And yet, their tools still land on “best of industry” lists written by others. The difference is authority. The strength of their tools earns them visibility.

These clusters made it clear how LexisNexis builds depth in high-intent searches. And we know there are many more such clusters hiding in plain sight. But since this study is already exhaustive, we didn’t go into all of them.

Zooming Out to Keyword Themes

Instead, we wanted to test one more angle. What happens when buyers search with broader buyer phrases. As in the kind of terms decision-makers often default to when searching: software, solutions, and tools.

We pulled the data, and here’s what popped up.

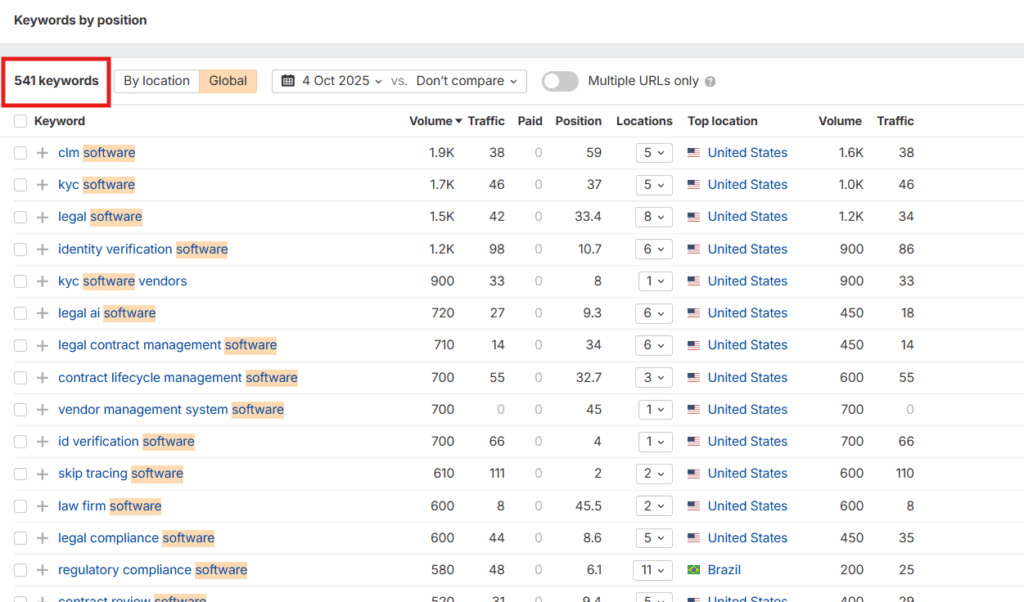

1. The “Software” Cluster

This is by far the largest pool, with 541 organic keywords. What’s striking is the spread across high-value enterprise categories:

- CLM software, legal software, contract lifecycle management software

- KYC software, identity verification software, regulatory compliance software

In other words, the software cluster reflects the depth of LexisNexis’ core offerings. The sheer variety here underlines that they don’t need listicles or comparison round-ups to validate them, their projects and platforms speak for themselves.

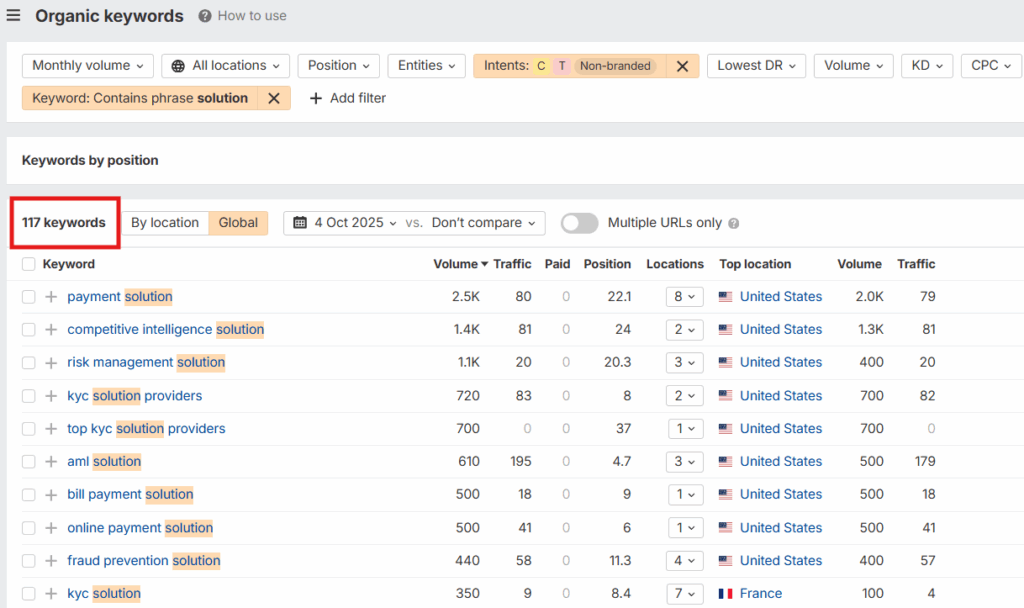

2. The “Solutions” Cluster

Here the emphasis shifts. The 117 keywords with “solution” lean heavily toward financial compliance and risk, like: Payment solution, AML solution, risk management solution, fraud prevention solution and Provider-related terms like KYC solution providers or top KYC solution providers.

This demonstrates that LexisNexis’ visibility isn’t limited to legal tech. Solution-led phrasing also signals high-intent buyers, the kind who are closer to implementation.

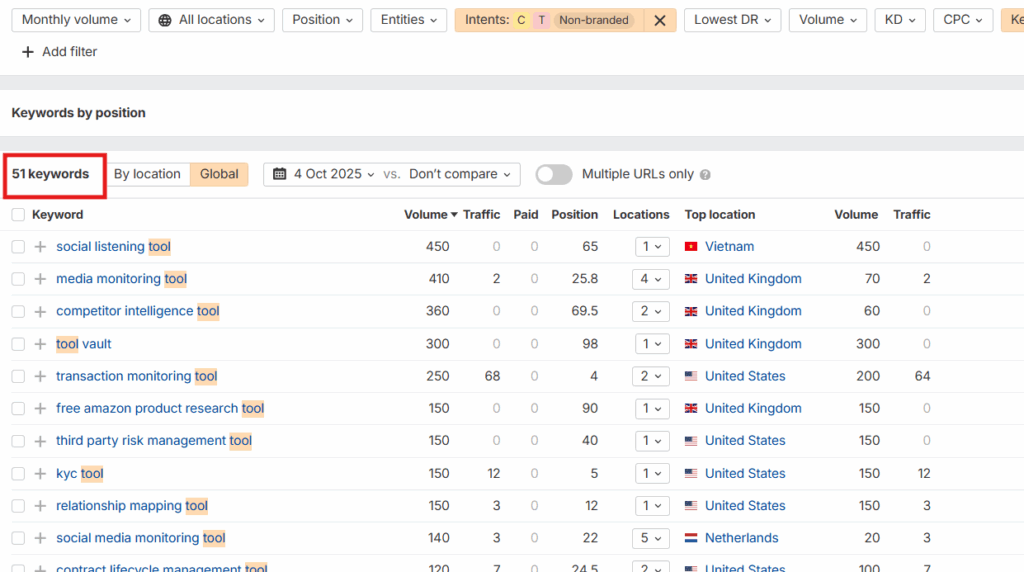

3. The “Tools” Cluster

While smaller at 51 keywords, the “tools” group reveals something interesting. These searches appear more often in UK/Europe than in the US. Think competitor intelligence tools, transaction monitoring tools, KYC tools, and social media monitoring tools.

LexisNexis shows up here too, which means their content and authority are flexible enough to capture regional language differences. Even when buyers default to “tools” — a less formal phrasing than “software” or “solution” — they’re still present.

Across all three clusters, the pattern is consistent. LexisNexis doesn’t just build pages, their authority earns them visibility in different buyer journeys and even in “best tool/solution/software” lists written by others.

Mapping Bottom-of-Funnel Patterns

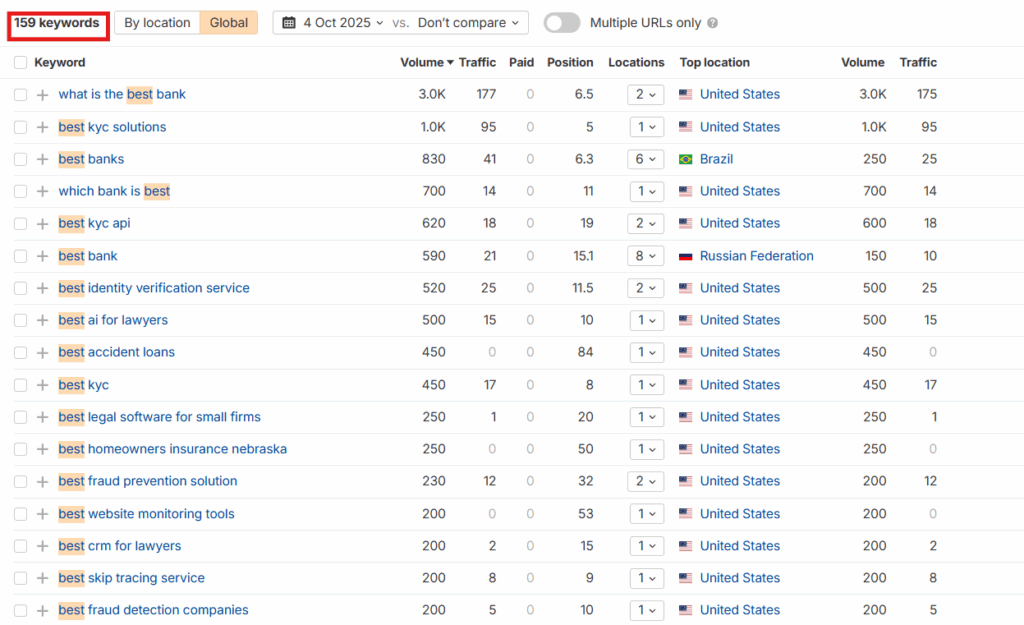

We also wanted to see how LexisNexis performs on bottom-of-funnel formats many B2B brands use. Phrases like “best” and “top” that usually show up when buyers are close to deciding.

When we filtered for keywords containing “best,” we found 159 organic rankings. These weren’t shallow listicles. The traffic largely came from their core solutions being featured by other publications in the best of comparisons and research reports.

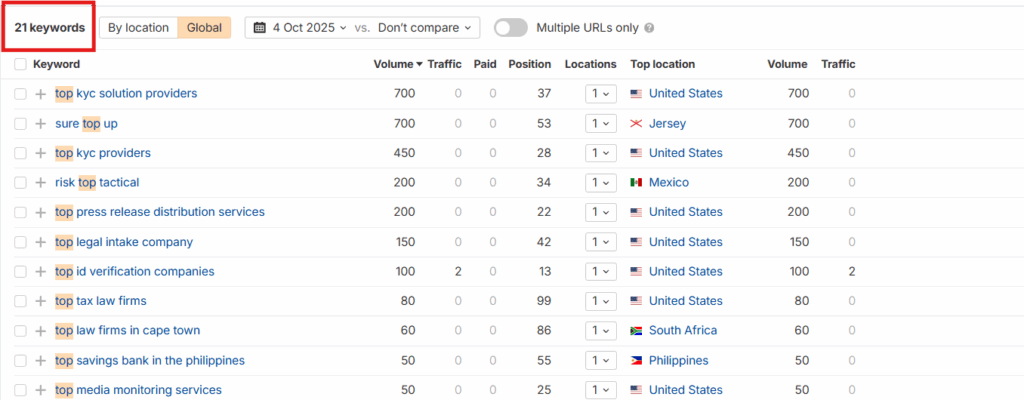

Next, we checked for “top” keywords. LexisNexis showed 21 rankings here. Interestingly, the phrases clustered again around their compliance and KYC ecosystem, such as top KYC solution providers, top ID verification companies, top media monitoring services.

This shows that even without chasing comparison-style content, their product relevance keeps them visible in buyer-ready searches.

Together, these clusters confirm a pattern: LexisNexis doesn’t depend on traditional “best of” or “top X” plays. Their brand equity and tool performance do the ranking, giving them organic visibility for phrases like “best KYC solution” or “top ID verification company” without having to publish such listicles themselves.

How LexisNexis Wins With “vs” Keywords

After exploring their commercial and transactional clusters, we wanted to see how LexisNexis handles comparison-intent keywords like “vs.”

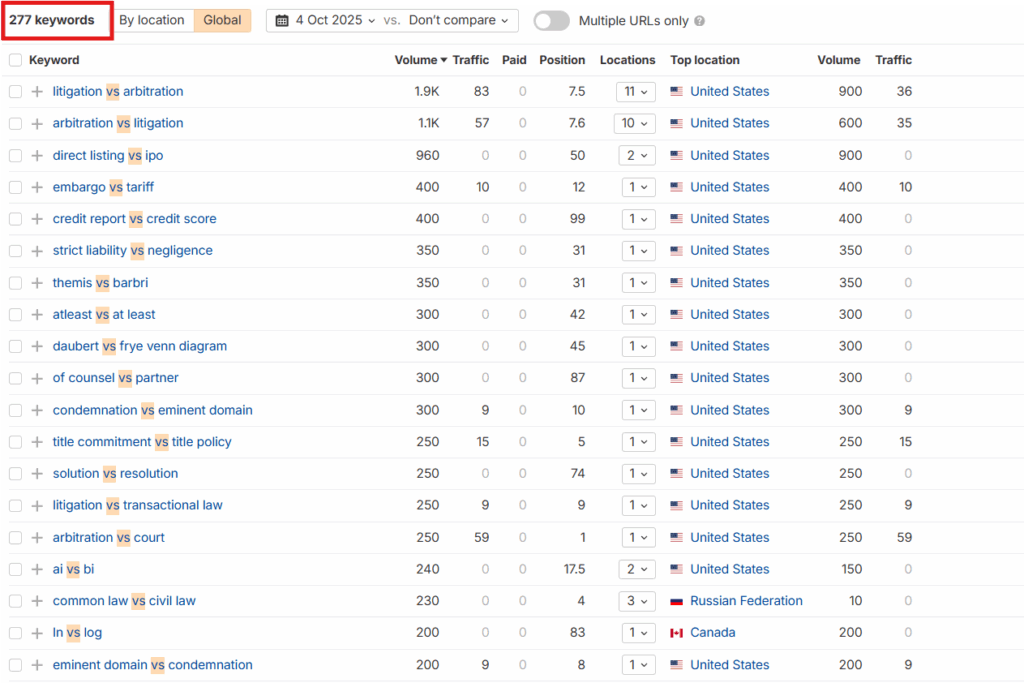

When we filtered for “vs” terms, an interesting pattern emerged. LexisNexis is ranking for 277 such keywords, from “litigation vs arbitration” and “13D vs 13G” to “strict liability vs negligence.”

But here they are not simply ranking due to authority. Each of these leads to a carefully structured resource, such as a dedicated glossary entry, blog article, or guidance page, which clarifies the difference between two legal concepts while quietly demonstrating expertise.

For instance:

- Litigation vs Arbitration is covered in LexisNexis Thought Leadership Blog – a plain-English breakdown with context, use cases, and references.

- Schedule 13D vs 13G is a Practical Guidance Resource complete with a downloadable comparison chart for compliance teams(It can be accessed after you fill a form sharing your work details).

- Condemnation vs Eminent Domain is another glossary-style article that turns a complex legal distinction into a searchable, evergreen asset.

What’s remarkable here is the depth and variety of formats, ranging from thought-leadership blogs to knowledge-center explainers, all feeding into the same intent: to educate and own the informational layer of the funnel.

Even without heavy commercial targeting, this approach keeps LexisNexis highly visible for high-value informational queries. Their content itself acts as the funnel, drawing readers into deeper products, reports, and legal tools naturally.

We’ll unpack how this authority-driven content play connects to their legal tech and software ecosystem in another piece. But for now, it’s clear that when it comes to “vs” keywords, LexisNexis has turned explanation into domination.

Recommended Read: 6 Proven Content Strategies That Can Help Generate Qualified Leads for Legal Tech Companies

3 Takeaways From The LexisNexis SEO Playbook

Of course, LexisNexis didn’t build this dominance overnight.

It’s the result of years of disciplined publishing, strong products, and credible authority. Their tools do much of the heavy lifting. But the content behind them is doing quiet, consistent work too. Here are three lessons worth taking away from this analysis:

1. Even authority brands still invest in fundamentals

Despite their stature, LexisNexis continues to create glossary-driven content, from “Litigation vs Arbitration” to “Schedule 13D vs 13G Filing Chart.” They don’t treat these topics as “too basic.” Instead, they use them to build discoverability, reinforce expertise, and meet top-of-funnel intent naturally.

2. They create content that earns its own backlinks

Their research posts, infographics, webinars, and legal insight reports get quoted and referenced across the web. Not because they chase backlinks, but because the content adds real utility. Authority follows value.

3. Their visibility comes from ecosystem thinking, not just pages.

This performance doesn’t stem from a handful of landing pages. LexisNexis runs multiple blogs, publishes across various regions, and sustains a steady rhythm of reports, glossaries, and thought leadership content. That breadth of presence makes their content ecosystem impossible to ignore.

Ultimately, what this shows is that dominance like this isn’t built by a single tactic or one campaign. It comes from connecting search strategy with strategic storytelling and consistent execution across every content format.

And if you’re aiming to build that kind of durable content engine, that compounds visibility over time, we at Concurate can help.

We specialize in structuring and scaling the kind of content clusters that make brands discoverable, trusted, and impossible to overlook.

Book our calendar and let’s design a content strategy that earns your brand the visibility and trust it truly deserves.

Related Read: 15 Content Marketing Agencies for B2B Legal Tech That Can Drive Signups, Free Trials, and Demo Requests