| TL, DR: Manufacturers don’t struggle with demand. They struggle with clarity, timing, and buyer trust. This guide breaks down the top digital marketing agencies for manufacturers and how each one approaches complex buying journeys. |

A manufacturing founder once told us this felt strange to admit. Their biggest competitors weren’t winning on pricing, capacity, or quality. They were winning before sales ever got involved.

According to Gartner, B2B buyers now spend over 70 percent of their buying journey researching independently before speaking to a vendor. That includes engineers validating specs, procurement teams comparing suppliers, and operations leaders looking for proof they won’t regret the decision.

This is where many manufacturers feel the friction. The product is solid, and the shop floor runs well. But online, the story falls apart. Websites explain what you make, not why it’s the safer or smarter choice. Sales ends up re-educating on every call, trade shows feel riskier, and growth becomes unpredictable.

Digital marketing hasn’t changed how manufacturing works. It’s changed how manufacturing is evaluated.

That’s why choosing the right B2B marketing agency is now a strategic decision, not a cosmetic one.

Top 10 B2B Digital Marketing Agencies for Manufacturers

In manufacturing, marketing rarely gets a second chance. Budgets are cautious, teams are lean. And when something doesn’t work, it quietly gets shelved.

That’s why the agencies that survive in this space look very different from mainstream B2B firms. They’re built to handle technical scrutiny, internal buy-in, and buying cycles that don’t move on a marketer’s timeline.

The list below features agencies that have learned to operate within those realities, not fight them.

- Concurate

- Konstruct Digital

- Gorilla 76

- Weidert Group

- Altitude Marketing

- Industrial Strength Marketing

- TREW Marketing

- BlackBean Marketing

- Kula Partners

- MFG Tribe

- Belkins

Let’s explore each one by one.

1. Concurate

Concurate exists because manufacturing marketing keeps getting treated like a lighter version of SaaS. And that never works.

If you’re a manufacturing founder, you’ve probably felt at least a few of these.

- Your sales team spends half the call explaining basics that should have been obvious from the website

- Buyers come in late, already comparing you to competitors you didn’t even know they were considering

- Marketing looks busy, but no one can confidently say how it’s helping close deals

- Your product is solid, but online it sounds like everyone else in the category

This is where we operate differently. What we’ve learned after pulling apart dozens of manufacturing marketing setups is pretty simple.

Founders aren’t confused about what to do. They’re frustrated because nothing seems to click together.

Source – Concurate

Our work starts at the moment when a buyer is already interested but not convinced yet.

That’s where most manufacturing marketing quietly fails.

In practice, this means we spend a lot of time doing this:

- Explaining your product online so your sales team doesn’t have to start from zero on every call

- Creating content for buyers who are already comparing vendors, not people casually reading blogs

- Building pages that help engineers, procurement, and leadership all reach the same conclusion without internal friction

- Supporting long evaluation cycles instead of pretending manufacturing deals close like SaaS signups

We’ve written extensively about why most B2B content fails when it ignores buying intent, and how manufacturers can fix that by focusing on evaluation-stage content instead of surface-level awareness.

We’ve also broken down how high-intent SEO works in categories where search volume is low but deal value is high, which is the reality for most manufacturers.

Concurate isn’t built to make marketing look good. It’s built to make buying easier.

If your product already works and your team already delivers, marketing shouldn’t be the weak link anymore. Contact us today to get your marketing on the right track!

Notable clients: Inspire IP, Triangle IP, Datacipher, Athena Security, and others

Pricing: Our partnerships typically range from USD 5,000 to USD 7,500 per month, with project-based work starting at USD 3,500.

2. Konstruct Digital

Konstruct Digital is a B2B digital marketing agency with a strong focus on industrial, manufacturing, and distribution companies. Their work is centered on helping manufacturers improve visibility during long and complex buying cycles, particularly when multiple stakeholders like engineering, procurement, and finance are involved.

Source – Konstruct

The agency operates across SEO, paid media, content marketing, and website optimization, with an emphasis on tying marketing activity to pipeline and revenue outcomes rather than surface-level engagement.

Konstruct positions its approach around how buyers actually evaluate vendors. This includes supporting technical research, vendor qualification, and comparison-driven decision-making. Their campaigns are designed to align marketing with sales processes, especially in environments where purchases are high-value, risk-sensitive, and slow-moving.

Notable clients: UFP Industries, Di-Corp, InterClean, Chamco, AbeTech, and several industrial equipment, components, and systems manufacturers.

Pricing: Konstruct Digital does not publicly list fixed pricing. Engagements are typically custom-scoped

3. Gorilla 76

Gorilla 76 is a B2B marketing agency focused on companies operating within the manufacturing ecosystem, including OEMs, custom machine builders, contract manufacturers, and industrial technology providers. The agency works across messaging, content, website strategy, and targeted demand programs, with an emphasis on helping buyers understand complex offerings throughout a long evaluation process.

Source – Gorilla 76

Their work centers on building clarity and consistency across channels that influence how decisions are made internally. This includes supporting technical influencers, enabling sales conversations with educational content, and improving how websites function as research assets rather than static brochures.

Alongside client work, Gorilla 76 invests heavily in educational initiatives such as events, podcasts, and learning resources aimed at manufacturing marketers.

Notable clients: Davron Technologies, and other industrial oven manufacturers, and custom-engineered capital equipment manufacturers.

Pricing: Engagements are typically structured as ongoing programs and scoped based on objectives, channels, and organizational complexity.

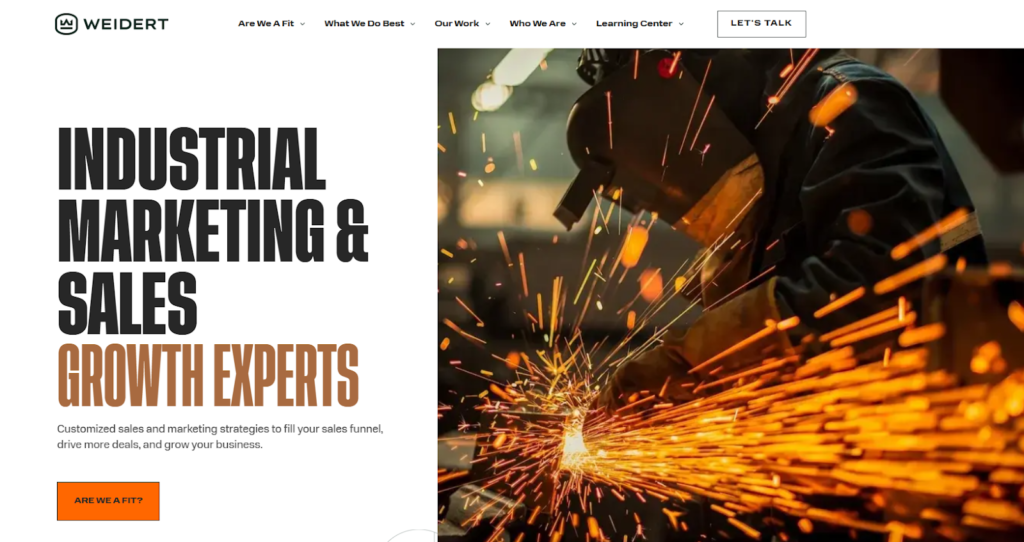

4. Weidert Group

Weidert Group comes from a sales-first background rather than a campaign-first one. Their work is built around helping industrial companies bring structure to how leads are generated, qualified, and moved through the funnel.

Source – Weidert Group

Much of their focus sits at the intersection of marketing operations, CRM, and sales enablement, especially for organizations trying to replace fragmented efforts with a repeatable system.

Instead of emphasizing channel execution upfront, Weidert leans heavily into planning, process design, and internal alignment. Their programs often involve HubSpot implementation, website restructuring, and automation that supports both revenue growth and internal efficiency.

Notable clients: Barcoding, Fox Valley Metal Tech, ESOP Partners

Pricing: Pricing is not published publicly. Engagements are typically scoped after an initial fit assessment and vary based on strategic depth, tooling, and program scope.

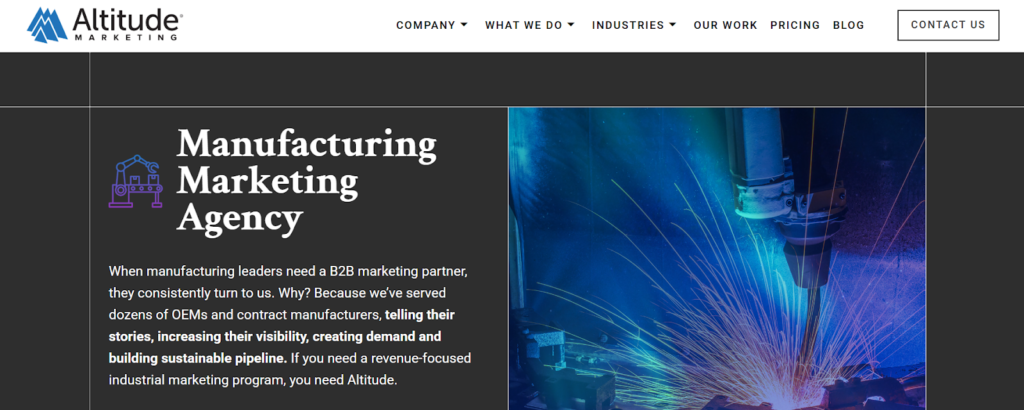

5. Altitude Marketing

Altitude Marketing approaches manufacturing growth through customer acquisition and brand-building rather than channel-first execution. The agency works with manufacturers that operate in competitive, high-consideration categories where visibility, positioning, and credibility directly affect deal velocity.

Its work spans strategy, branding, content, SEO, digital advertising, and web development, often supporting companies navigating expansion, category leadership, or acquisition readiness.

Source – Altitude Marketing

Altitude places emphasis on how manufacturers are perceived across diverse audiences, from engineers and product teams to sales leaders and executives.

Their programs are structured to handle long buying cycles, complex approvals, and multiple decision-makers, while maintaining consistency across messaging, design, and demand generation. This makes their approach suitable for manufacturers balancing growth with reputation and long-term brand equity.

Notable clients: Patrick, Worldnet, Forney, Olympus, Discovery Life Sciences

Pricing: Altitude Marketing offers tiered monthly retainers, starting at $9,500–$12,500 for organic growth programs, $12,500–$16,000 for integrated digital acceleration, and $16,000+ per month for fully customized, end-to-end marketing engagements.

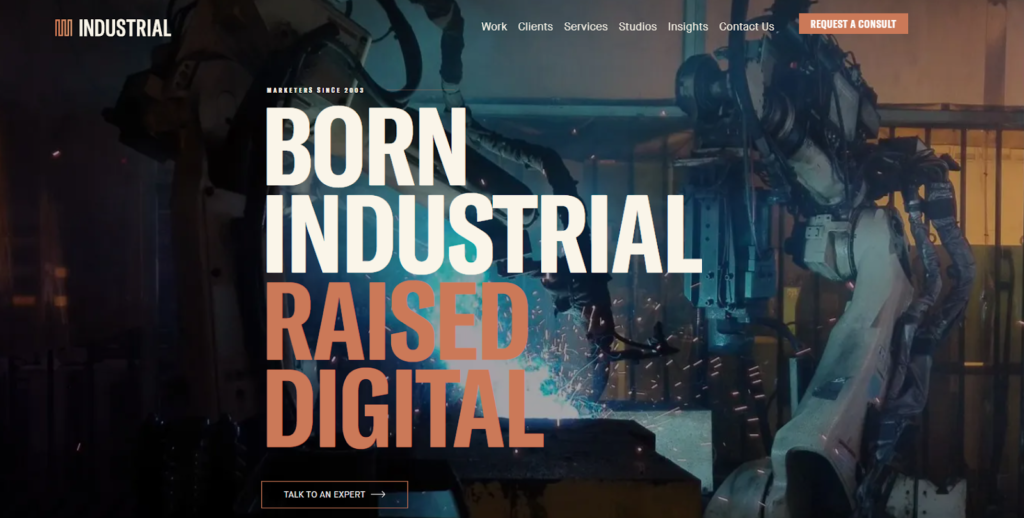

6. Industrial Strength Marketing

Industrial Strength Marketing positions itself around the idea of reducing friction between how manufacturers sell and how buyers now evaluate options. The agency works with OEMs, fabricators, and contract manufacturers that are adapting to buyers who research online, compare alternatives, and look for proof before engaging sales. Their services cover planning, content creation, demand generation, and sales enablement.

Source – Industrial

Their approach emphasizes buyer education and internal sales readiness. Alongside content programs like videos, case studies, and how-to assets, they focus on equipping sales and channel partners to handle objections and maintain consistency as teams evolve.

Notable clients: United Grinding, Hunter Industrial, Duroair, IranCAD, Mills Products Incorporated

Pricing: Industrial Strength Marketing does not publish pricing publicly. You can contact their team for more information.

7. TREW Marketing

TREW Marketing is built around serving organizations with highly technical products and engineering-led buying audiences.

Source – TREW

Its work spans marketing strategy, brand positioning, content development, and marketing automation, with a strong emphasis on long-term planning and structured execution.

A defining aspect of TREW’s approach is its orientation toward engineers and technical evaluators. Programs are designed to support detailed research, specification-driven comparisons, and internal justification across the buyer journey.

Alongside client work, TREW invests in original research, workshops, and training initiatives aimed at improving how technical teams communicate and scale demand without oversimplifying their offerings.

Notable clients: Infinitum, Ansys, Wineman Technology, CertTech, Genuen

Pricing: TREW Marketing does not publicly disclose pricing. Engagements are typically scope-based.

8. BlackBean Marketing

BlackBean Marketing tends to work in situations where manufacturing teams know growth is possible but feel stretched trying to get there. Rather than introducing heavy frameworks or layered campaigns, the agency focuses on stabilizing the basics first.

That often means tightening positioning, fixing visibility gaps, and giving leadership clearer direction on where marketing effort should actually go.

Source – BlackBean

Their work shows up most clearly in how they support smaller and mid-sized industrial teams. Fractional CMO support, focused SEO and website work, and brand clarity are used to create momentum without overwhelming internal resources.

The approach favors steady progress over experimentation, which aligns well with manufacturers that value reliability, predictability, and measurable follow-through.

Notable clients: Diablo Nutrients, Project Electric, Goodman Steel Ltd., ClearSolv, Altec

Pricing: Costs are discussed after understanding the client’s requirements.

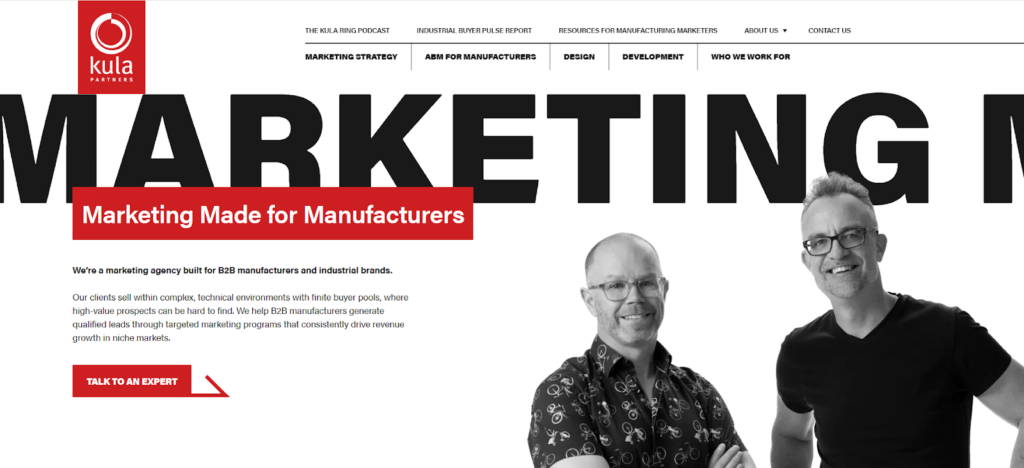

9. Kula Partners

Kula Partners operates in corners of manufacturing where volume is limited, buyers are known, and precision matters more than reach. Their work is shaped around manufacturers selling into niche, technical categories where a handful of accounts can define growth for years.

Source – Kula Partners

Instead of chasing scale, the agency focuses on helping teams get sharper about who really matters, how buying committees think, and where marketing effort creates the most leverage.

A defining aspect of Kula’s work is how deeply it leans into buyer insight and internal alignment. Their strategy often starts with understanding decision dynamics, then translating that insight into account-based programs, structured messaging, and purpose-built digital experiences.

Notable clients: OMRON, TE Connectivity, Avery Dennison, GE HealthCare, Emerson, Henkel, and Xometry

Pricing: Fees are shaped by engagement type and scope rather than preset monthly tiers.

10. Belkins

Belkins approaches manufacturing growth from the opposite side of the funnel. Instead of waiting for buyers to arrive through content or search, the agency focuses on proactively putting manufacturers in front of decision-makers through structured outbound programs.

Their work centers on appointment setting, lead research, and multi-channel outreach using email, phone, and LinkedIn, particularly for manufacturers selling into narrow, hard-to-reach markets.

Source – Belkins

The agency’s model is heavily process-driven. Campaigns are built around defined ICPs, manual prospect research, and coordinated touch sequences designed to support long sales cycles rather than quick conversions.

This makes Belkins a common fit for manufacturers that already have sales capacity but struggle with consistency at the top of the pipeline, especially when expanding into new regions, verticals, or enterprise accounts.

Notable clients: GE HealthCare, Sekisui, Simply NUC, Omnicharge, Bag Corp, Smartrek, and AMI.

Pricing: Belkins publishes baseline pricing for manufacturing-focused programs, with starter engagements beginning around $6,500 per month.

| How we shortlisted these agenciesThere’s no perfect way to rank agencies, especially in manufacturing. So we kept this simple and practical, the same way most founders actually evaluate partners.We started with one question. Would this agency realistically understand how manufacturing companies sell and grow today?Here’s what we looked at.Real manufacturing experience: Agencies that have worked with OEMs, contract manufacturers, or industrial brands, not just generic B2B or SaaS companies. Ability to handle long sales cycles: We prioritised teams that build for evaluation, trust, and internal buying committees, not quick lead spikes. Clarity over complexity: Agencies that explain complex products clearly, without dumbing them down or hiding behind jargon. Evidence of impact: Case studies, client outcomes, or consistent proof that their work supports revenue, not just activity.This list isn’t about who shouts the loudest. It’s about who actually fits the reality most manufacturing teams operate in. |

What Manufacturers Should Actually Look For In A Digital Marketing Agency

Most manufacturing founders don’t get agency selection wrong because they’re careless. They get it wrong because agencies know how to sell themselves better than they know how manufacturing works.

Here are a few things that genuinely matter, pulled straight from real situations we see.

- Someone who understands your sales calls: If an agency can’t explain what your sales team hears every day, objections, comparisons, internal approvals, they won’t help much. A good agency should make your sales calls easier, not longer.

- Comfort with slow decisions: Manufacturing deals don’t move fast. If an agency keeps pushing for quick wins or weekly spikes, that’s a red flag. You want a partner who’s comfortable building trust over months, not chasing short-term noise.

- Proof they can explain complex products: Look at how they write. If everything sounds generic, they’ll struggle with your specs, certifications, or custom workflows. Ask yourself, would an engineer actually read this?

- A mindset beyond leads: Leads are nice. But manufacturers need agencies that think about evaluation, comparison, and justification. The kind of content buyers use to convince others internally.

- Willingness to say no: The best agencies push back. They won’t run every idea. They’ll tell you when something won’t work in your category.

Once you start evaluating agencies this way, it becomes obvious why Concurate is built differently from most manufacturing marketing partners.

Why Manufacturing Teams Choose Concurate

Let’s be honest for a second.

If marketing were actually helping buyers understand your value early, you wouldn’t still be explaining the same things on every sales call.

That’s the gap Concurate fixes.

We don’t try to sound clever. We make sure buyers arrive informed. Clear on what you do, how you compare, and why choosing you makes internal sense. That’s why our work leans heavily into decision-stage content, evaluation pages, and high-intent search visibility.

You can see this approach clearly in our programmatic SEO case study, where we built pages around real evaluation questions and helped buyers find answers at scale. Not more noise. Just clearer paths to a decision.

If your sales team is still doing most of the educating, marketing isn’t doing its job yet.

Let’s change that. Book our calendar and we’ll walk through where buyers are getting stuck.

Frequently Asked Questions

1. How is marketing for manufacturing companies different from other B2B industries?

Manufacturing buying cycles are longer, more technical, and involve multiple stakeholders like engineers, procurement, and leadership. Marketing must support research, comparison, and internal justification over time. Generic B2B tactics often fail in marketing because they don’t address technical depth, risk assessment, or complex approval processes.

2. What should manufacturers prioritize when choosing a digital marketing agency?

Manufacturers should look for agencies that understand complex products, long sales cycles, and multi-stakeholder buying. Practical experience matters more than flashy creatives. The right agency should help reduce sales friction, support evaluation-stage content, and align marketing outputs with how real buying decisions happen.

3. Are SEO and content marketing still effective for manufacturing companies?

Yes, but only when focused on buyer intent. Educational blogs alone rarely drive impact. Effective manufacturing SEO targets evaluation queries, comparison searches, and problem-specific use cases. Content should help buyers shortlist suppliers, understand tradeoffs, and justify decisions internally, not just introduce the category.

4. Why do many manufacturing marketing efforts fail to deliver ROI?

Most failures come from misalignment. Marketing often focuses on awareness while sales needs support later in the buying cycle. Without content that answers technical, pricing, and comparison questions, buyers stay confused and sales teams compensate manually. This disconnect limits scalability and measurable returns.

5. Should manufacturers work with niche agencies or full-service digital agencies?

Niche agencies often perform better because they understand industry-specific buying behavior and constraints. Full-service agencies can work if they adapt their approach, but many rely on SaaS playbooks that don’t translate well. The key is choosing a partner that builds around your sales reality, not generic frameworks.

Disclaimer:The information presented in this article is compiled from publicly available sources, including company websites, industry reports, and social media. All trademarks, brand names, and logos mentioned are the property of their respective owners. This article is intended for informational purposes only.